How Much Are Property Taxes In Ct . First, take the 100% appraised value of the property and multiply by 70% to get the assessed. Local governments within the state use various. 177 rows this is how to calculate property taxes in connecticut. Compare your rate to the connecticut and u.s. the ct property tax rates vary from municipality to municipality. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. There are different mill rates for different. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. property taxes in connecticut. The average effective property tax rate in connecticut is 2.13%, but this can vary.

from taxfoundation.org

property taxes in connecticut. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The average effective property tax rate in connecticut is 2.13%, but this can vary. Compare your rate to the connecticut and u.s. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. There are different mill rates for different. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Local governments within the state use various. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. the ct property tax rates vary from municipality to municipality.

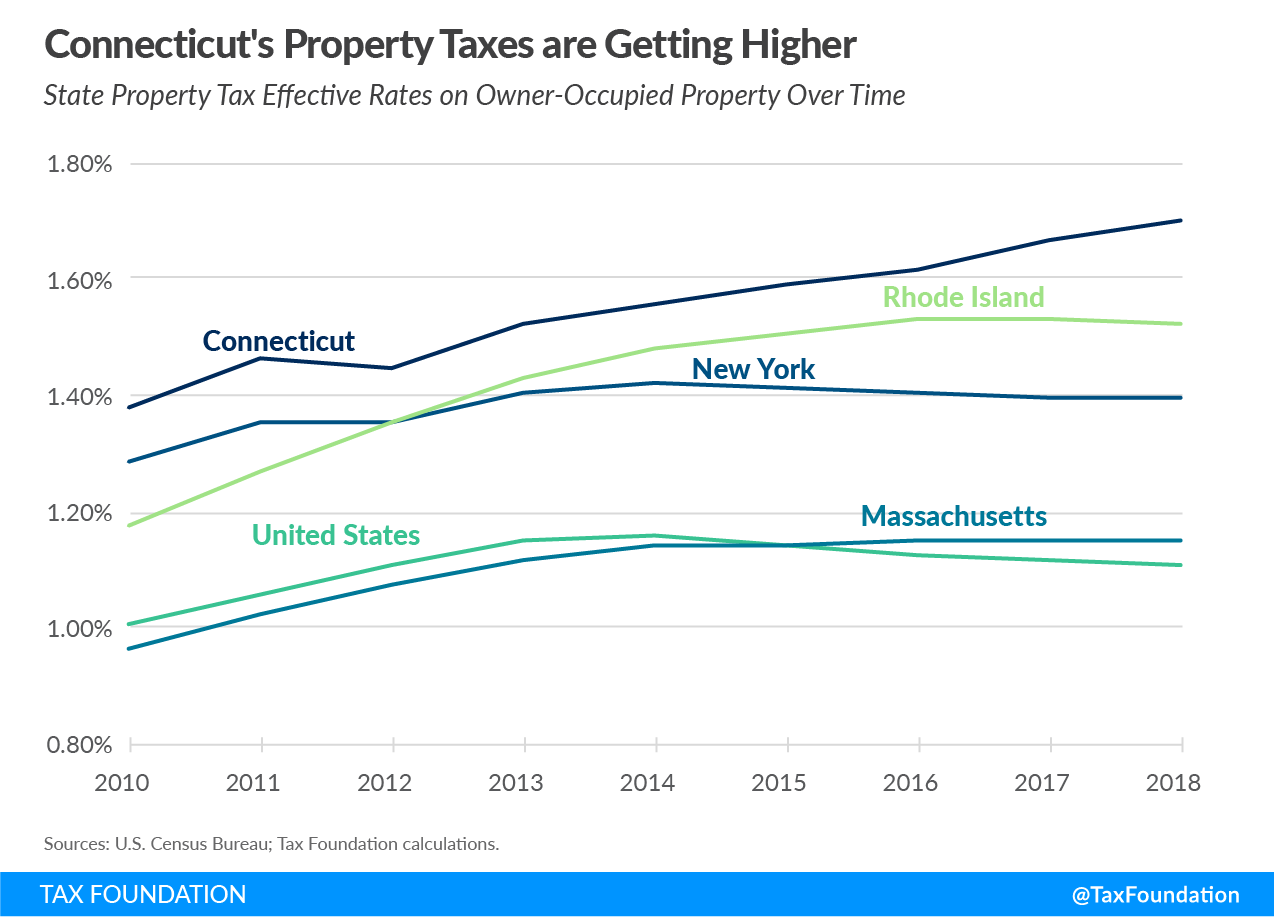

What Connecticut Can Learn from its Neighbors Property Tax Limitations

How Much Are Property Taxes In Ct calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The average effective property tax rate in connecticut is 2.13%, but this can vary. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. Compare your rate to the connecticut and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. the ct property tax rates vary from municipality to municipality. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. There are different mill rates for different. 177 rows this is how to calculate property taxes in connecticut. Local governments within the state use various. property taxes in connecticut.

From patch.com

Connecticut Property Taxes In Every Town Who Pays The Most? Across How Much Are Property Taxes In Ct to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Local governments within the state use various. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. the ct property tax rates vary from municipality to municipality. Compare your rate to the. How Much Are Property Taxes In Ct.

From upstatetaxp.com

What Can Connecticut Learn from its Neighbors About Property Tax How Much Are Property Taxes In Ct 177 rows this is how to calculate property taxes in connecticut. property taxes in connecticut. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. Compare your rate to the connecticut and u.s. the ct property tax rates vary from municipality to municipality. There are different mill rates for different.. How Much Are Property Taxes In Ct.

From yankeeinstitute.org

Connecticut has 2nd highest tax collection rate in the country Yankee How Much Are Property Taxes In Ct There are different mill rates for different. Local governments within the state use various. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. 177 rows this is how to calculate property taxes in connecticut. First, take the 100% appraised value of the property and multiply by 70% to. How Much Are Property Taxes In Ct.

From hubpages.com

Which States Have the Lowest Property Taxes? HubPages How Much Are Property Taxes In Ct property taxes in connecticut. There are different mill rates for different. The average effective property tax rate in connecticut is 2.13%, but this can vary. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. calculate how much you'll pay in property taxes on your home, given your. How Much Are Property Taxes In Ct.

From www.steadily.com

Connecticut Property Taxes How Much Are Property Taxes In Ct The average effective property tax rate in connecticut is 2.13%, but this can vary. 177 rows this is how to calculate property taxes in connecticut. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. the ct property tax rates vary from municipality to municipality. There are different mill rates for. How Much Are Property Taxes In Ct.

From www.yankeeinstitute.org

Connecticut’s Tax Where Did the Money Go? Yankee Institute How Much Are Property Taxes In Ct to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Local governments within the state use various. The average effective property tax rate in connecticut is 2.13%, but this can vary. 177 rows this is how to calculate property taxes in connecticut. There are different mill rates for different.. How Much Are Property Taxes In Ct.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills How Much Are Property Taxes In Ct The average effective property tax rate in connecticut is 2.13%, but this can vary. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. There are different mill rates for. How Much Are Property Taxes In Ct.

From www.kiplinger.com

Connecticut State Tax Guide Kiplinger How Much Are Property Taxes In Ct First, take the 100% appraised value of the property and multiply by 70% to get the assessed. the ct property tax rates vary from municipality to municipality. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. property taxes in connecticut. The average effective property tax rate in. How Much Are Property Taxes In Ct.

From darienite.com

Study Connecticut Has the Fourth Highest Property Taxes in the Country How Much Are Property Taxes In Ct Compare your rate to the connecticut and u.s. 177 rows this is how to calculate property taxes in connecticut. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. calculate how. How Much Are Property Taxes In Ct.

From nataliewirina.pages.dev

Texas Property Tax Increase 2024 Alicia Meredith How Much Are Property Taxes In Ct property taxes in connecticut. 177 rows this is how to calculate property taxes in connecticut. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Local governments within. How Much Are Property Taxes In Ct.

From www.youtube.com

Property Taxes in CT YouTube How Much Are Property Taxes In Ct There are different mill rates for different. The average effective property tax rate in connecticut is 2.13%, but this can vary. the ct property tax rates vary from municipality to municipality. 177 rows this is how to calculate property taxes in connecticut. First, take the 100% appraised value of the property and multiply by 70% to get the. How Much Are Property Taxes In Ct.

From www.eunduk.com

세 종류의 각 소득에 대한 택스는? How Much Are Property Taxes In Ct First, take the 100% appraised value of the property and multiply by 70% to get the assessed. Local governments within the state use various. There are different mill rates for different. 177 rows this is how to calculate property taxes in connecticut. to calculate the property tax, multiply the assessment of the property by the mill rate and. How Much Are Property Taxes In Ct.

From patch.com

Connecticut Property Taxes In Every Town Who Pays The Most How Much Are Property Taxes In Ct First, take the 100% appraised value of the property and multiply by 70% to get the assessed. the ct property tax rates vary from municipality to municipality. The average effective property tax rate in connecticut is 2.13%, but this can vary. Local governments within the state use various. to calculate the property tax, multiply the assessment of the. How Much Are Property Taxes In Ct.

From www.dagnysrealestate.com

Connecticut Mill Rates Property Taxes Dagny's Real Estate How Much Are Property Taxes In Ct Compare your rate to the connecticut and u.s. the ct property tax rates vary from municipality to municipality. The average effective property tax rate in connecticut is 2.13%, but this can vary. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. There are different mill rates for different. . How Much Are Property Taxes In Ct.

From www.linkedin.com

2023 CT Mill Rates by Town How Much Are Property Taxes In Ct Compare your rate to the connecticut and u.s. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. First, take the 100% appraised value of the property and multiply by 70% to get the assessed. calculate how much you'll pay in property taxes on your home, given your location. How Much Are Property Taxes In Ct.

From suburbs101.com

Connecticut Property Tax Calculator 2022 Suburbs 101 How Much Are Property Taxes In Ct 177 rows this is how to calculate property taxes in connecticut. the ct property tax rates vary from municipality to municipality. property taxes in connecticut. The average effective property tax rate in connecticut is 2.13%, but this can vary. to calculate the property tax, multiply the assessment of the property by the mill rate and divide. How Much Are Property Taxes In Ct.

From www.stlouis-mo.gov

How to Calculate Property Taxes How Much Are Property Taxes In Ct There are different mill rates for different. to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Compare your rate to the connecticut and u.s. the ct property tax rates vary from municipality to municipality. First, take the 100% appraised value of the property and multiply by 70% to. How Much Are Property Taxes In Ct.

From patch.com

Connecticut Has The 2nd Highest Tax Rates In the U.S. New Report How Much Are Property Taxes In Ct First, take the 100% appraised value of the property and multiply by 70% to get the assessed. 177 rows this is how to calculate property taxes in connecticut. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the ct property tax rates vary from municipality to municipality. . How Much Are Property Taxes In Ct.